The Impact of Gamification on User Engagement Across All Generations and Demographics

Industry

Financial Services

Challenge

The financial institution faced difficulties retaining customers, with low engagement levels and underutilization of key app features across a diverse user base. To remain competitive, they needed a strategy that would increase retention, encourage repeat usage, and drive deeper product adoption.

Results

By implementing Finotta’s gamification features, the institution saw a 41% increase in deposit account retention, a 13X boost in time spent in-app, and significant improvements in user engagement across all age groups. The personalized, gamified experience drove higher feature adoption, stronger financial habits, and long-term customer loyalty.

Driving Engagement, Retention, and Financial Wellness Through Gamification

Community financial institutions face a common challenge: how to keep users engaged while supporting financial wellness across a diverse customer base. From retirees seeking stability to younger, tech-savvy customers exploring financial independence, meeting the needs of such varied demographics requires more than standard digital tools.

That’s why Finotta—a gamification-driven solution was designed to help financial institutions create more personalized, rewarding digital experiences while boosting retention, engagement, and financial wellness.

The Challenge: Engagement Gaps Across Diverse Demographics

Financial institutions often struggle to engage their entire customer base effectively. Common challenges include:

• Retention Struggles: Acquiring new customers can cost up to 25 times more than retaining existing ones, making long-term engagement critical.

• Underutilized Features: Users often overlook valuable financial tools or fail to revisit digital channels regularly.

• Diverse User Needs: Serving a wide age range, from retirees to young professionals, demands more personalized strategies tailored to different life stages and financial goals.

A more dynamic, customer-centric approach was needed—one that could encourage positive financial behaviors while keeping users consistently engaged.

The Solution: Gamification Built for All Users

We designed technology with gamification at its core, blending personalized financial guidance with interactive elements to create a more engaging digital banking experience.

Rather than passively presenting financial tools, the platform turns financial wellness into a rewarding, user-driven experience:

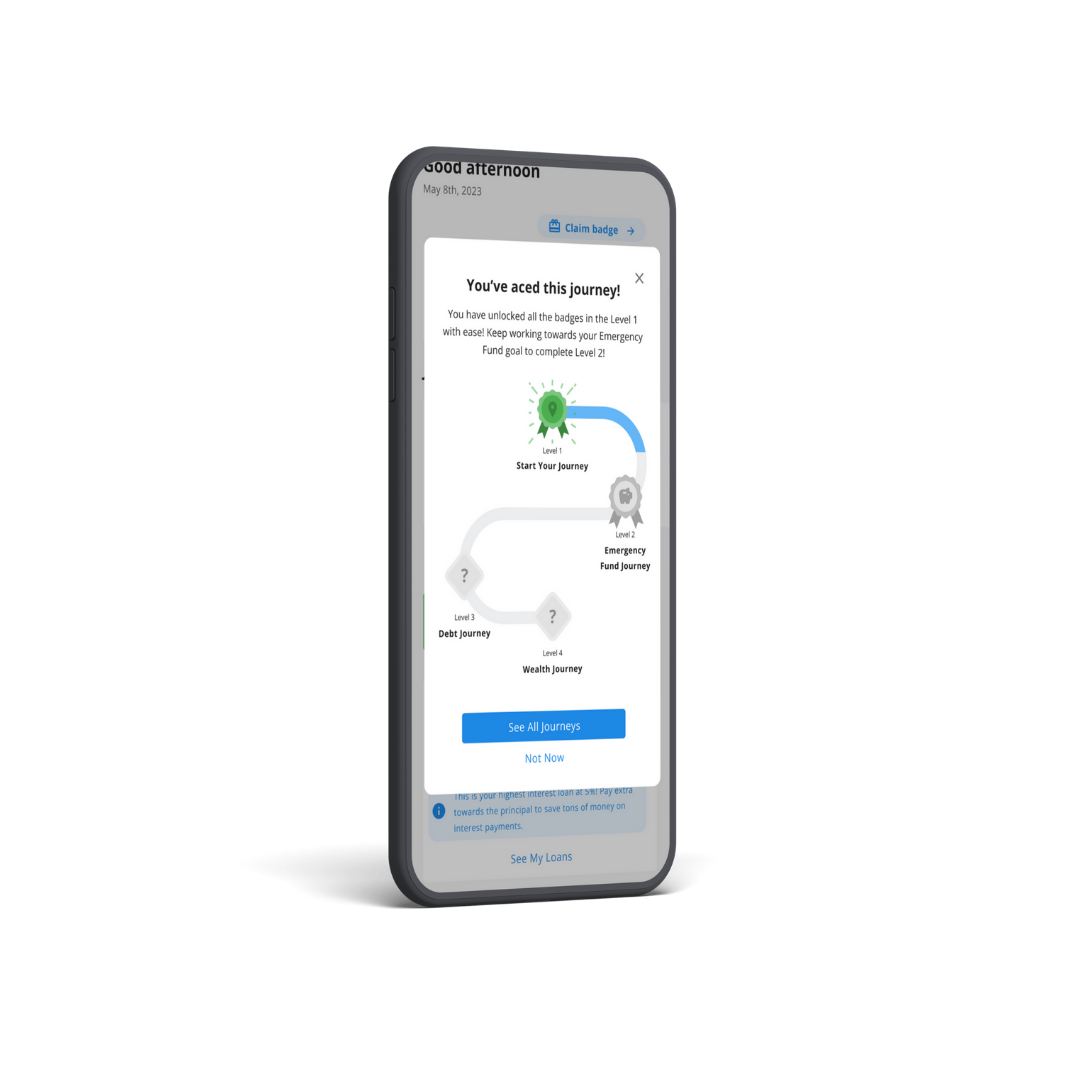

• Achievement Badges: Users earn badges for reaching financial milestones, such as meeting savings goals or completing financial tasks.

• Personalized Financial Guidance: Dynamic recommendations tailored to each user’s financial behaviors and life stage help make progress feel achievable.

• Progress Tracking: Visual progress indicators provide a clear picture of financial health, motivating users to stay on track and reach their goals.

• Confetti Celebrations: Moments of success are amplified with confetti effects to celebrate user wins—creating positive emotional connections to financial progress and reinforcing a stronger relationship with the financial institution through the mobile app.

The result? More active users, stronger retention, and better financial outcomes across all demographics.

The Impact: Industry-Wide Success Metrics

Institutions leveraging Finotta have seen measurable success across key performance indicators:

• 41% Increase in Deposit Retention: Gamification encouraged users to stay actively engaged with their institution.

• 13x More Time Spent In-App: Session times averaged 13 minutes, demonstrating stronger digital engagement when compared to industry average.

• 35% Increase in Average Accounts per Customer: Users explored multiple financial products, deepening their relationships with the institution.

Additional Performance Highlights:

• 17% Increase in monthly active users

• 12% Increase in monthly returning users

• 54% Increase in users following personalized financial guidance

These results go beyond metrics—they reflect stronger relationships between financial institutions and the communities they serve.

Engaging Every Generation—From Retirees to Young Professionals

Gamification through Finotta proved effective across all age groups:

• 37% of users were aged 35-49, balancing family expenses with long-term goals.

• 23% of users were aged 50-65, leveraging progress tracking to monitor financial health.

• 17% of users were aged 19-30, motivated by goal-based challenges and interactive features.

The combination of progress tracking, personalized guidance, celebratory badges, and confetti for milestone wins created positive emotional connections to financial progress, making financial wellness feel accessible—and rewarding—for everyone.

Why Gamification Works Across Demographics

The success of Finotta can be attributed to four key factors:

1. Retention Built on Value: The 41% increase in deposit retention highlights how gamification sustains long-term engagement. Users of all demographics spend more time in the application based on personalized recommendations and gamification features.

2. Deeper Digital Engagement: A 13x increase in session duration proves interactive tools, like progress tracking and celebratory moments, keep users involved longer.

3. Broad Generational Appeal: From retirees monitoring financial progress to younger users seeking achievement badges and confetti celebrations, the experience resonates across all life stages.

4. Financial Impact: A 54% increase in users following personalized guidance shows how gamification drives positive financial behaviors. These personalized recommendations push the right next step for every user, providing value on every log-in.

Gamification: A Universal Growth Strategy for Financial Institutions

Finotta demonstrates that gamification isn’t just a feature—it’s a powerful, scalable strategy for community financial institutions seeking to drive retention, deepen engagement, and promote financial wellness.

By transforming digital channels into interactive, rewarding experiences filled with positive reinforcement—like achievement badges, personalized guidance, progress tracking, and confetti celebrations—institutions can not only improve performance but also build stronger, lasting connections with the people they serve.

For financial institutions ready to create more personalized, engaging experiences for all generations, gamification is the path forward.